The release of PCI DSS 4.0 in 2024 represents an important milestone in the evolution of payment security standards. This update was developed to tackle the challenges posed by today’s fast-changing technology, particularly the rapid rise of mobile payment solutions.

The safety of mobile payment systems has become a serious concern as cyberattacks grow not only in number but also in sophistication. One striking incident from 2024, known as the ‘Ghost Tap’ attack, exposed worrying flaws in trusted platforms like Apple Pay and Google Pay raising serious doubts about the reliability of these widely trusted services. Adding to the problem is the rise of mobile crypto-jacking—a tactic where cybercriminals exploit users’ smartphones without their knowledge to mine cryptocurrency in the background.

The financial industry hasn’t been spared either where there’s been a 29% rise in banking malware incidents and an eye-opening 111% jump in mobile spyware attacks.

PCI DSS 4.0 does more than just enhance the protection of payment card data—it also recognizes how the world of payments is changing. With mobile apps now at the heart of financial transactions, these new guidelines are designed to tackle the unique security challenges of today’s mobile-dominated payment landscape.

Core Objectives of PCI DSS 4.0

Enhancing Security:

The security of financial transactions has been a top priority under PCI DSS 4.0, and the updated standard aims to protect APIs, payment SDKs, and authentication processes by addressing vulnerabilities.

Advanced encryption is a major part of this effort, working behind the scenes to keep sensitive data safe as it moves between systems. For mobile app developers, it’s about taking extra steps to ensure sensitive information, like cardholder data, is always encrypted during transmission and storage. This also means following secure coding practices to avoid potential flaws and routinely testing applications to identify and fix security gaps.

Flexibility

Because every business operates differently with its own set of functions, PCI DSS 4.0 embraces this reality by giving organizations room to customize their security strategies. For instance, if your mobile app uses containerized architectures, you can implement controls designed specifically for microservices without stepping outside compliance boundaries.

Moreover, the updated PCI DSS understands that there’s no universal approach to security and in the case of mobile apps, for example, anything from biometric authentication to token-based systems—or even stick to traditional passwords—depending on what fits their users and the risks involved.

On top of that, if an organization can prove that an alternative approach offers the same level of protection, it’s now allowed. This means businesses can innovate without compromising on security.

Simplicity

Not only does the PCI DSS 4 framework make compliance easier for mobile applications, but it also provides clearer guidance on how to implement security controls. For example, not limiting to specific encryption algorithms, for example, PCI DSS 4’s focus shifts to simpler requirements and updated reporting templates in PCI DSS 4.0, and organizations can more easily implement and maintain compliance.

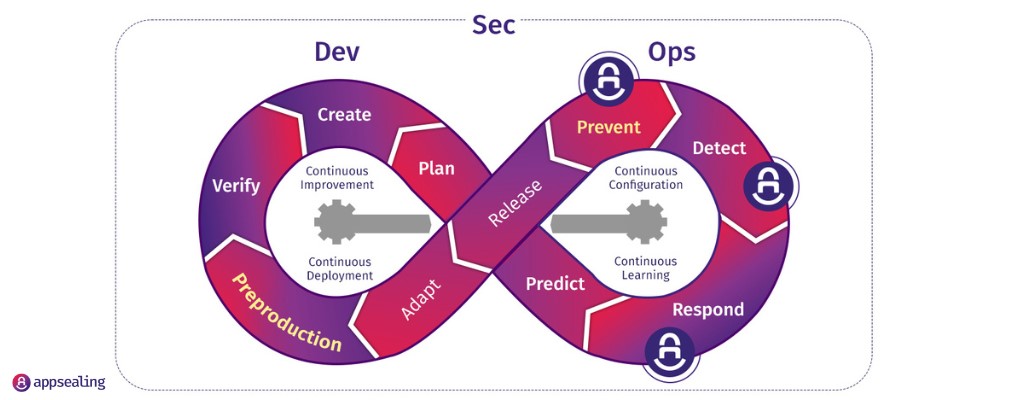

Continuous Compliance

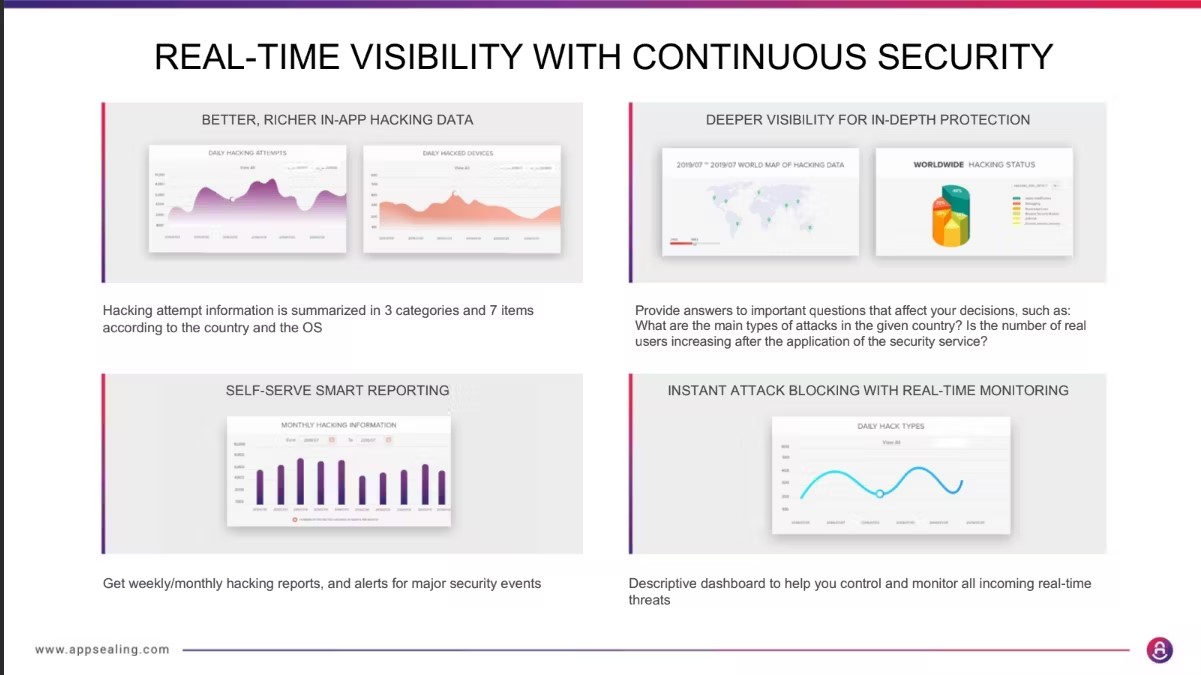

PCI DSS 4.0 takes mobile app security compliance from being a one-and-done activity to an ongoing responsibility. For mobile app development teams, this means integrating essential practices like continuous monitoring, regular security testing, and automated vulnerability scans right into the development process.

Mobile app developing teams are urged to rely on real-time monitoring tools to protect cardholder data consistently. By embracing this continuous mindset, businesses can not only stay ahead of potential threats but also move beyond simply meeting compliance requirements—it becomes part of their everyday operations.

Key Changes in PCI DSS 4.0

Customized Approach to Security

With the advent of the “Customized Approach” feature in PCI DSS 4.0, now organizations can design controls that align more closely with their specific risk profiles. For mobile appsec approaches, the tussle between Compensating Controls vs Customized Approach means focusing on the security measures that matter most, such as analyzing user behavior or transaction patterns. Mobile app developers now have the flexibility to implement tools like data masking or tokenization that are adapted to the app’s unique architecture, all while ensuring they remain compliant.

Expanded Multi-Factor Authentication (MFA)

Multi-Factor Authentication (MFA) is now mandatory for all access points to cardholder data environments (CDE), including administrative and non-console access.

When we think of mobile app admin panels, this could mean adding an additional layer of security, such as biometric authentication (fingerprint or facial recognition), to protect sensitive data even further.

Enhanced Focus on Continuous Compliance

Mobile app developers are strongly encouraged to incorporate practices like automated vulnerability scanning and ongoing monitoring to maintain PCI DSS compliance at all times.

With real-time threat detection and automated security testing in CI/CD pipelines, mobile apps that process payments can be set up to keep an eye on suspicious API requests, ensuring compliance remains active and uninterrupted.

Stronger Encryption Standards

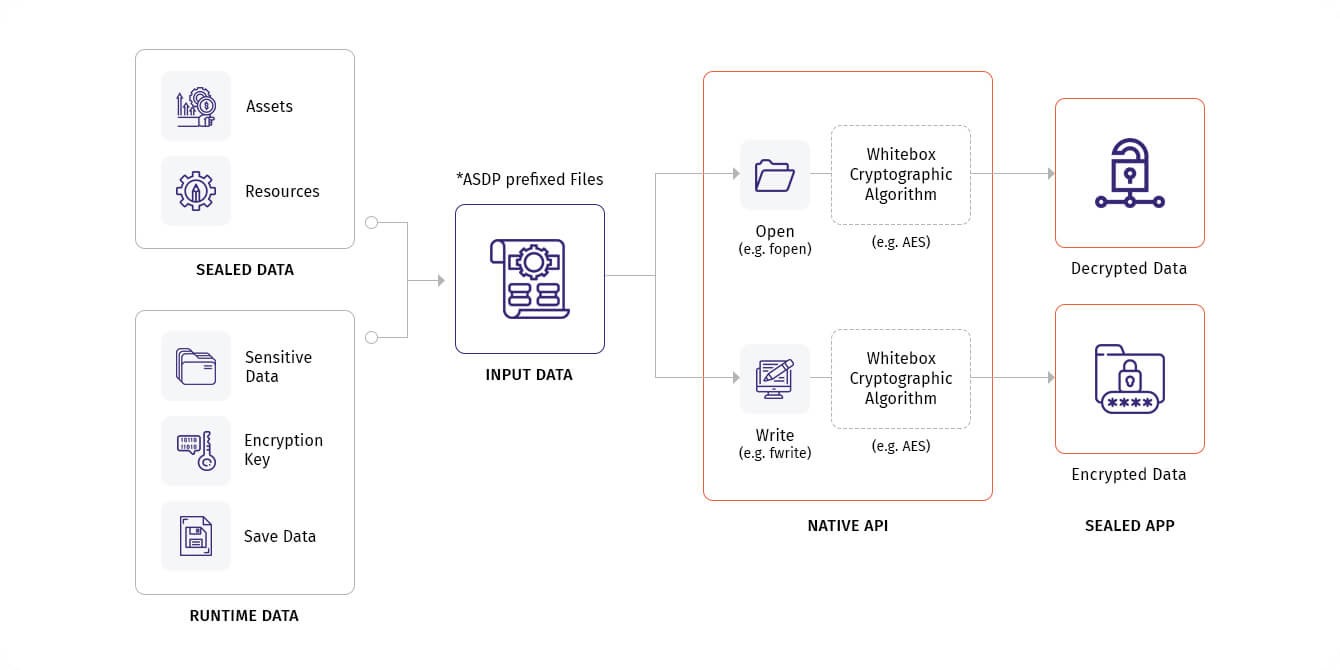

PCI DSS 4.0 mandates stronger encryption protocols for transmitting and storing cardholder data. Mobile applications must utilize advanced encryption standards (AES) with appropriate key management practices to protect sensitive information from unauthorized access. This includes implementing:

- TLS 1.2 or higher for network communications

- Platform-specific encryption APIs (like Keychain for iOS or KeyStore for Android)

- Secure key management practices

More Detailed Reporting Requirements

Mobile developers need to maintain detailed logs of technical and operational requirements that include access attempts, transactions, and any anomalies detected within the application.

Support for Cloud Environments

As PCI DSS 4.0 impacts the entire payment card supply chain, securing cloud services for securing payment data by mobile apps is no exception. PCI DSS 4 thrives on proper setup, encryption, access management, and ongoing monitoring becomes more evident in PCI DSS 4.

Greater Emphasis on Risk Assessments

By conducting customised risk assessments, organizations are now required to spot potential vulnerabilities and threats unique to their operations. For mobile apps, this means evaluating the risks related to third-party libraries, APIs, and how user data is managed to minimize exposure to security issues.

Implementation Strategies for PCI DSS 4.0

-

Conduct a Gap Analysis

A gap assessment to analyze and review an organization’s cardholder data environment (CDE) provides detailed comparison, to identify areas where current practices and areas that need attention, of current security posture vis-a-vis PCI DSS 4 requirements.

-

Build a Risk-Based Security Framework

With targeted and risk based controls, PCI DSS 4 incorporates risk assessments into the app development process, to identify and mitigate risks associated with payment transactions. Further, with this approach, developers can focus on securing sensitive data storage before implementing advanced features. A relevant example in this case could be to prioritize securing API endpoints in mobile apps against injection attacks.

-

Upgrade Authentication Protocols

Implement modern authentication frameworks that support MFA and secure session management. Consider using frameworks like Auth0 or Firebase Authentication that provide ready-to-use security features.

-

Invest in Automation Tools

Utilize automation tools for vulnerability scanning, compliance monitoring, and incident response processes to streamline efforts and ensure consistent adherence to PCI standards.

-

Train Your Workforce

Regular training sessions should be conducted for developers and staff involved in handling payment data, emphasizing secure coding practices and awareness of PCI DSS requirements. Regular training on topics like secure API implementation and data encryption is crucial.

-

Collaborate with Qualified Security Assessors (QSAs)

Work with QSAs who have experience with mobile application security to ensure your implementation meets PCI DSS 4.0 requirements.

-

Implement Robust Encryption

Use platform-recommended encryption methods and ensure proper key management. Ensure that all sensitive data transmitted or stored by the mobile application is encrypted using strong algorithms like AES-256, along with proper key management protocols. For example, use the Android Keystore system or iOS Keychain for secure key storage.

-

Strengthen Vendor Management

Ensure third-party libraries and SDKs used in your mobile app meet security requirements and are regularly updated.

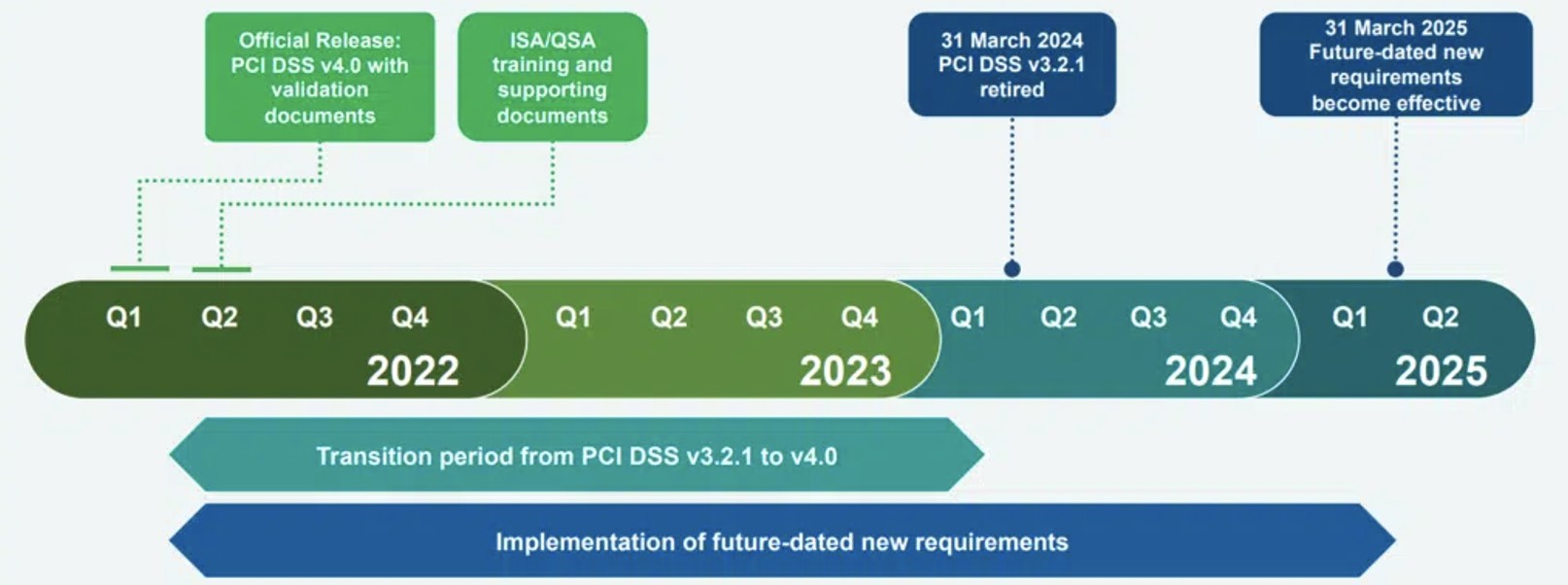

Timeline and Deadlines for PCI DSS 4.0 Compliance

- March 31, 2024: The previous version (PCI DSS 3.2.1) will officially retire; all organizations must transition to PCI DSS 4.0 by this date.

- Grace Period: Some requirements in PCI DSS 4.0 have a grace period until March 31, 2025, allowing organizations additional time for implementation.

Challenges in Transitioning to PCI DSS 4.0

- Resource Constraints: Many organizations may face challenges due to limited resources (financial or human) when transitioning to the new standards.

- Technical Complexity: The technical demands of implementing enhanced security measures can be significant, especially for teams unfamiliar with new technologies or protocols required by PCI DSS 4.0.

- Vendor Dependencies: Organizations relying on third-party vendors may encounter difficulties if those vendors do not meet the updated compliance requirements or lack necessary support for mobile application integration.

Benefits of Adopting PCI DSS 4.0

Stronger Data Security:

Implementing PCI DSS 4.0 enhances overall data security by enforcing rigorous controls over how cardholder information is handled within mobile applications.

Improved Customer Trust:

Demonstrating compliance with PCI DSS fosters trust among customers who are increasingly concerned about the safety of their financial information when using mobile apps for transactions.

Regulatory Alignment:

Adhering to PCI DSS helps organizations align with other regulatory frameworks related to data protection and privacy laws, reducing legal risks associated with non-compliance.

Operational Efficiency:

By integrating security into the development lifecycle and automating compliance processes, organizations can achieve greater operational efficiency while maintaining high-security standards in their mobile applications.

Conclusion

PCI DSS 4.0 represents a significant evolution in payment card security standards that addresses modern threats while providing flexibility for organizations—especially those developing mobile applications—to tailor their compliance strategies effectively. By understanding its requirements and implementing best practices early on, businesses can enhance their security posture while fostering customer trust in their payment processes.